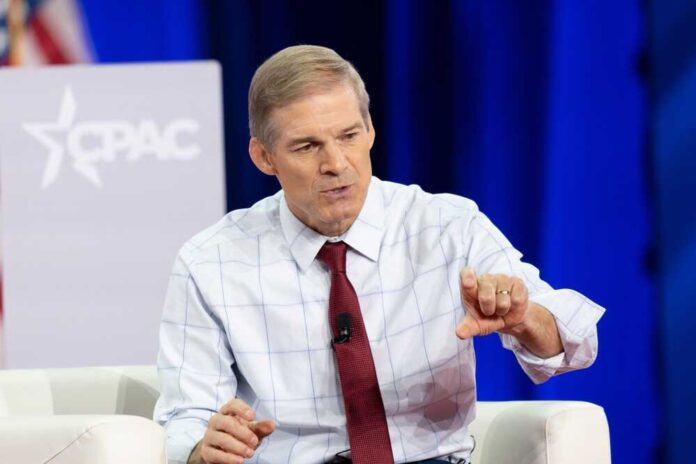

House Judiciary Committee Chairman Rep. Jim Jordan (R-OH) is joining several other Republican representatives to investigate the status of environmental, social and governance (ESG) investing. The effort comes as a number of companies have started distancing themselves from the controversial program.

Jordan and two Republican representatives send letters to investment firms BlackRock and Vanguard, requesting information regarding their use of ESG standards. The members of Congress expressed concern that the companies may be breaking U.S. antitrust laws through potential collusion.

“Collusive agreements harm competition and consumers and are illegal under the Sherman Act,” the letter read.

The Republicans requested a series of documents related to the use of ESG by the companies, with a particular focus on decarbonization efforts.

“Accordingly, to advance our oversight and inform potential legislative reforms, we write to ask BlackRock to produce relevant documents and information,” it says.

Woke Corporations Emerge as America’s ‘Big Brother’ – The Messenger

My latest @TheMessenger https://t.co/JYAXQWWkFt

— Kristin B. Tate (@KristinBTate) June 23, 2023

In March, President Joe Biden vetoed a Republican-led bill related to the use of ESG by the Department of Labor (DOL).

The veto was Biden’s first, and the president described the effort as one which would “risk your retirement savings by making it illegal to consider risk factors MAGA House Republicans don’t like.”

The bill attempted to overturn a DOL rule which would allow fund managers to include factors such as climate change and wider ESG efforts when determining retirement investments.

The current push against ESG investing comes as a number of companies have recently distanced themselves from using such activist-led language.

Earlier this month, BlackRock CEO Larry Fink told Fox News that the term had been “weaponized.”

Fink said that he no longer used the term. He cited recent weather trends and said that the company still prioritized environmental efforts.

“In the state of Florida and the state of Texas, the state of California, major, major property and casualty companies, big brands are leaving the states because they can’t elevate the price to meet their returns on homeowners,” Fink said. “And we’re displacing really a large segment of America today that are not going to be able to afford homeowners insurance if they are in an area of risk.”

“To me, that’s where climate is investment risk,” he said.